It does more than record the total money a business receives from the transaction. Sales journal entries should also reflect changes to accounts such as Cost of Goods Sold, Inventory, sales journal and Sales Tax Payable accounts. At the end of each accounting period (usually monthly), the sales journal double entry is used to update the general ledger accounts.

Get Your Questions Answered and Book a Free Call if Necessary

The discount that the buyer takes for paying early is stored as a sales discount by the seller. While the payment is due at the end of the same month as the month of sale, the terms are written as n/eom (end-of-month). To encourage the buyer to pay before the due date, the seller usually offers a discount.

How to Record a Sales Journal Entry [with Examples]

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- A ledger, on the other hand, is where the results of the transactions are kept permanently.

- Business website CNBC.com said the Federal Reserve is expected to decrease rates by another half-point this year and by a full point in 2025.

- A Sales Journal, also known as the Sales Day Book, is a specialized accounting journal used to record all credit sales of merchandise.

Although it may seem quite simple, this record-keeping tool can be a powerful asset for your business. This way, it will be easier to analyze the effects of the transactions than if they were recorded in one journal. An item can be returned to the seller, which is a sales return. In addition, for reasons of damaged goods, defects or other reasons, the seller can reduce the price of the goods / provide sales discounts (sales allowance). Say cash the seller is receiving within the discount period (10 days) from a credit sale of $1,500,000 and VAT of 10%.

Table of Contents

The processing load that the clearing agency or credit card issuing bank pays is about 2-3% of the sales transaction figure. Cash sales usually go to the cash register and will get a record in the accounts. As a refresher, debits and credits affect accounts in different ways. Assets and expenses are increased by debits and decreased by credits.

As has been already mentioned, a journal is where a financial transaction is first recorded. Sales to customers who pay in cash should not be recorded here, but instead entered in the Cash Receipts Journal. Also, merchandise or inventory purchases paid by cash should not be recorded in this journal as it is exclusively for credit purchases. Using the reference information, if anyone had a question about this entry, he or she would go to the sales journal, page 26, transactions #45321 and #45324. This helps to create an audit trail, or a way to go back and find the original documents supporting a transaction. Let’s say your customer purchases a table for $500 with cash.

Home sales in Delaware fall in August while prices rise. What’s the impact of rate cuts?

- The use of a reference code in any of the special journals is very important.

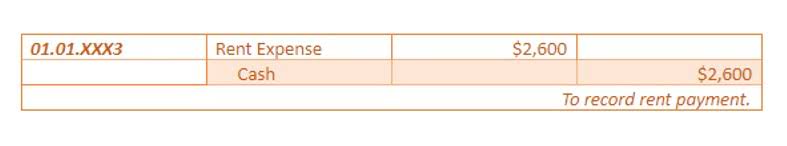

- When journal entries are recorded for sales, debits and credits must be created for specific accounts.

- The discount that the buyer takes for paying early is stored as a sales discount by the seller.

- While all companies maintain a single journal for bookkeeping records, some companies like to divide journals into multiple types which makes it easy to track down financial records.

- When posting to the accounts receivable ledger, a reference to the relevant page of the journal would be included.

Most often these sales are made up of inventory sales or other merchandise sales. Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal. Both cash and credit sales of non-inventory or merchandise are recorded in the general journal. Many companies enter only purchases of inventory on account in the purchases journal. Some companies also use it to record purchases of other supplies on account.

Q: Are accounts payable affected by sales?

3 Analyze and Journalize Transactions Using Special Journals

- Even for a firm with only several hundred sales a month, using a sales journal can save considerable time.

- An entity should maintain Sales Journal in the prescribed format by generally accepted accounting principles for an accounting of credit sale transactions so that Debtors’ records and credit sales records can be managed.

- We would enter these four types of transactions into their own journals, respectively, rather than in the general journal.

- That would follow a sluggish 1.4% annual growth pace in the first quarter, the slowest since spring 2022.

- The budget also includes continued funding to replace police and fire radios and for trailer cameras in areas with high levels of reckless driving to record incidents and use in subsequent enforcement, Kovac said.

- All the sales on account for June are shown in this journal; cash sales are recorded in the cash receipts journal.

- Account receivables are mentioned when the client purchases a product or service on credit, and sales are mentioned when the client purchases a product or service and pays for it through cash.